Latvijas Bankas konference "Globālās problēmas un lokālās iespējas: Baltijas valstu sasniegumi un perspektīvas"

Latvijas Banka 2011. gada 12. oktobrī organizēja gadskārtējo tautsaimniecības konferenci, kuras tēma šoreiz: "Globālās problēmas un lokālās iespējas: Baltijas valstu sasniegumi un perspektīvas".

-

Par konferenci

Latvijas Banka 2011. gada 12. oktobrī organizē gadskārtējo tautsaimniecības konferenci, kuras tēma šoreiz: "Globālās problēmas un lokālās iespējas: Baltijas valstu sasniegumi un perspektīvas".

Konferenci ar ievadreferātu atklās Latvijas Bankas prezidents Ilmārs Rimšēvičs.

Eiro zonas parādu krīzes risinājumu kontekstā konferences dalībniekiem klātienē un interneta tiešraidē noteikti būs interesanta Eiropas Centrālās bankas Valdes un Padomes locekļa Dr. oec. Jirgena Štarka (Jürgen Stark) uzstāšanās "Ekonomiskās korekcijas monetārajā savienībā". Jirgens Štarks ir labi zināms Eiropas ekonomists, viens no Eiropas vienotās valūtas arhitektiem.

Kā ierasts, tālāk konference noritēs divās daļās – ar starptautisku ekspertu un vietējā tirgus dalībnieku skatījumu un diskusiju.

Pirmā daļa "Ekonomiskās norises Eiropā un to ietekme uz Baltijas valstīm: akadēmiskais un politiskais skatpunkts" būs veltīta eiro ieviešanas analīzei – nesen notikušajai pārejai uz ES vienoto valūtu Igaunijā un sagaidāmajai Latvijā. Viens no diskusijas dalībniekiem – Somijas Bankas padomnieks Mertens Ross (Märten Ross) – strādājis par Igaunijas Bankas viceprezidentu no 2000. līdz 2011. gadam, tādējādi ietekmējot eiro ieviešanas procesu. Tas arī ļauj viņam spriest par to, kā Igaunija sasniegusi un nostiprinājusi makroekonomisko stabilitāti globālās finanšu un Eiropas parādu krīzes apstākļos.

Otrajā daļā "Latvijas eksports: potenciāls, problēmas un nākotnes iespējas", izsekojot uzņēmuma, nozares pārstāvniecības, bankas un eksportu veicinošās valsts institūcijas stāstam, būs iespēja saredzēt, vai pašlaik sasniegtajam straujajam eksporta kāpumam ir ilglaicīgs pamats, atrast vājos ķēdes posmus un diskutēt par praktiskiem darbiem uzņēmumu konkurētspējas uzlabošanai.

-

Latvijas Bankas prezidenta Ilmāra Rimšēviča ievadrunas video

-

Latvijas Bankas prezidenta Ilmāra Rimšēviča ievadrunas teksts

Ladies and gentlemen!

I am truly happy to greet you at already the eighth annual conference of the Bank of Latvia!

This is an opportunity for us to analyse again the situation in the economy, have a wider public discussion and perhaps even come to an agreement. To come to a consensus about what is going on in the world and what should or shouldn't we do in Latvia. This time we tried to pick even more interesting subjects and presenters, from far and near. Because it is essential to realise also what is the context in the global economy, perceive the dominating sentiment in the euro area and the European Union! This would enable us to better understand what is happening in the world and what lies ahead for Latvia. To understand whether there is anything that we can influence or whether all we can do is just stand and watch.

Ladies and gentlemen, we have to realise that Latvia is standing at the crossroads!

Not only the lives of our children but also those of our grandchildren will depend on the road Latvia takes. Therefore, Latvia must not make a mistake, it must not be led astray by misjudgements, must not give in to deception. The price paid for failing to adopt the euro in 2008 has been too high. You may ask what difference it would have made if we had introduced the euro already in January 2008. Our reply: – The crisis would not have been that deep!

- Unemployment would have been lower and the number of people having left Latvia smaller.

- We would not have had to save "Parex banka" and "Banka Citadele" would not have been established.

- Government debt would not have grown five times from 1 billion lats to 5 billion lats.

- We would not have to pay a huge amount equivalent to the one budgeted for the whole education sector as loan interest. Every year!

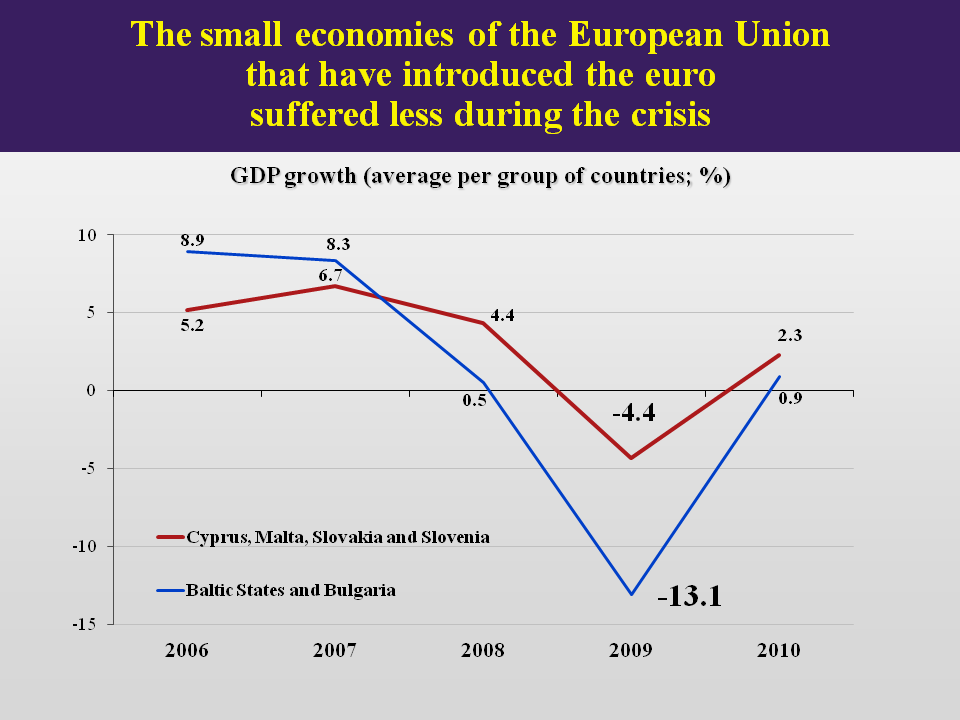

Of course, the developments in the euro area have also raised a couple of questions and have caused some doubt whether Latvia should be heading there at all. Yet the answer remains unchanged: certainly yes. Why? Let's look at the economic situation in the small euro area economies during the crisis.

What happened in Latvia, the Baltic States overall and other small EU countries within the euro area. The crisis was much milder in the latter.

But I would like to focus on Estonia today:

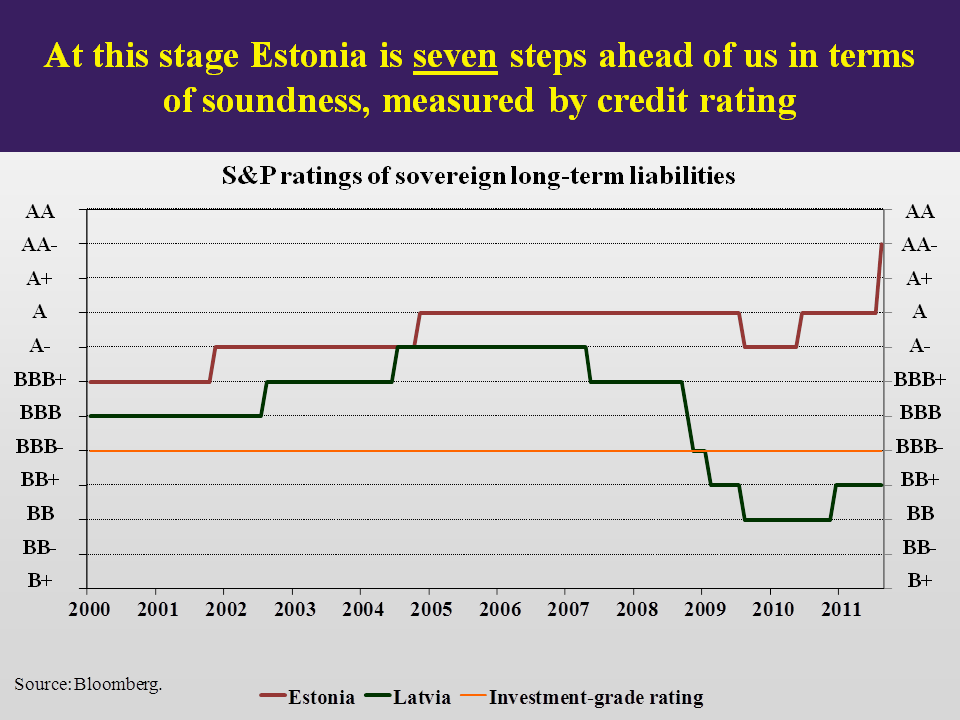

Estonia's credit rating vis-á-vis that of Latvia's. You may have seen it already. It is 7 notches higher. Latvia stands 7 notches lower than Estonia;

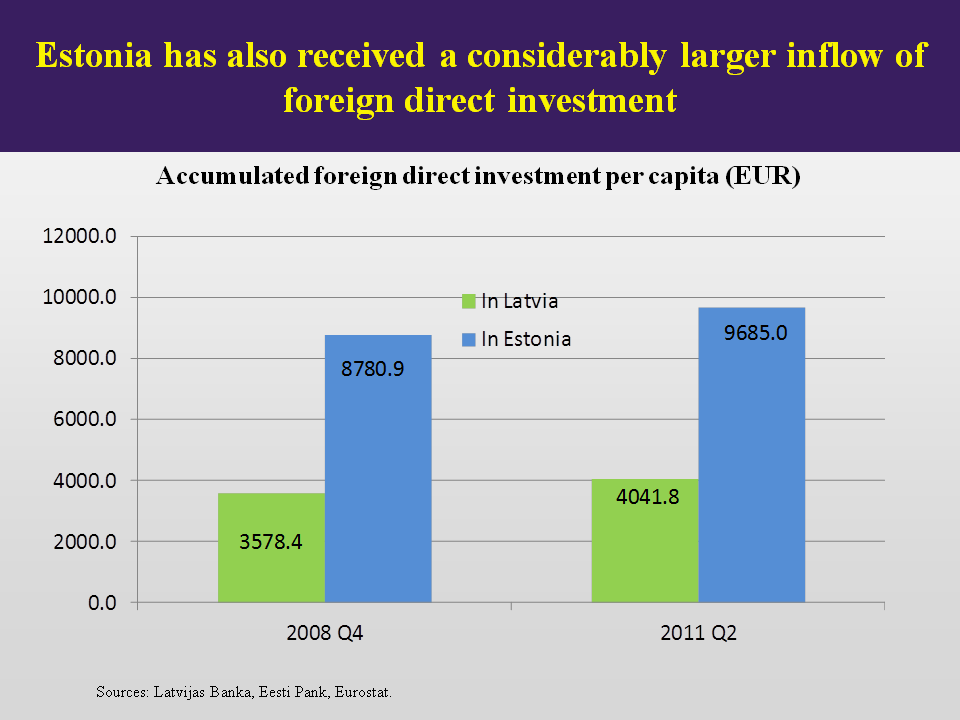

investment is 2 times, almost 2.5 times larger than in Latvia;

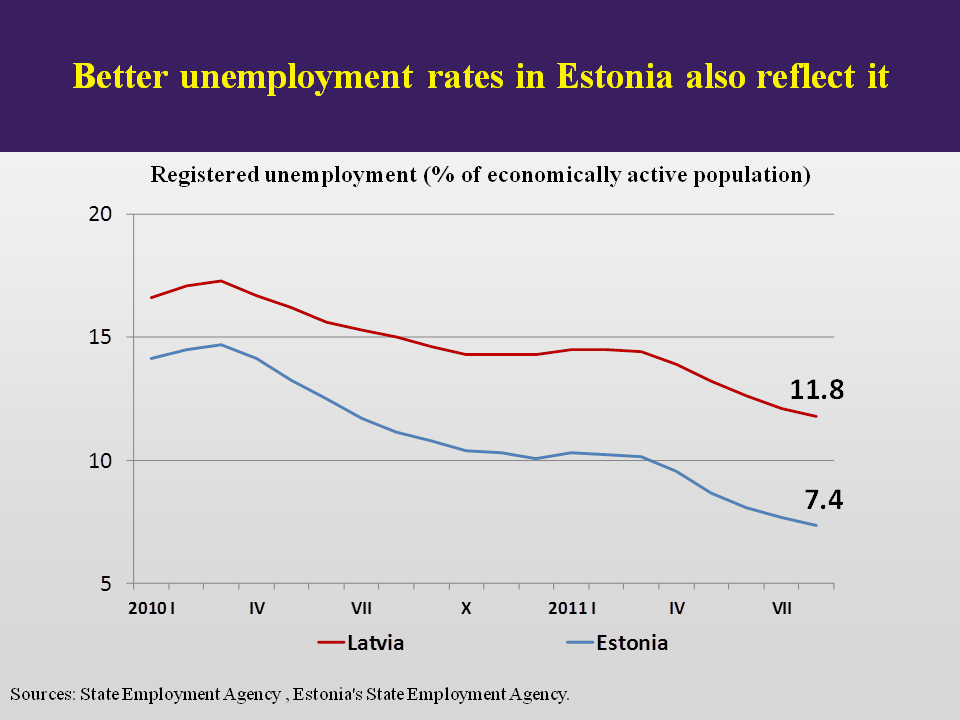

unemployment is lower by almost a half in Estonia;

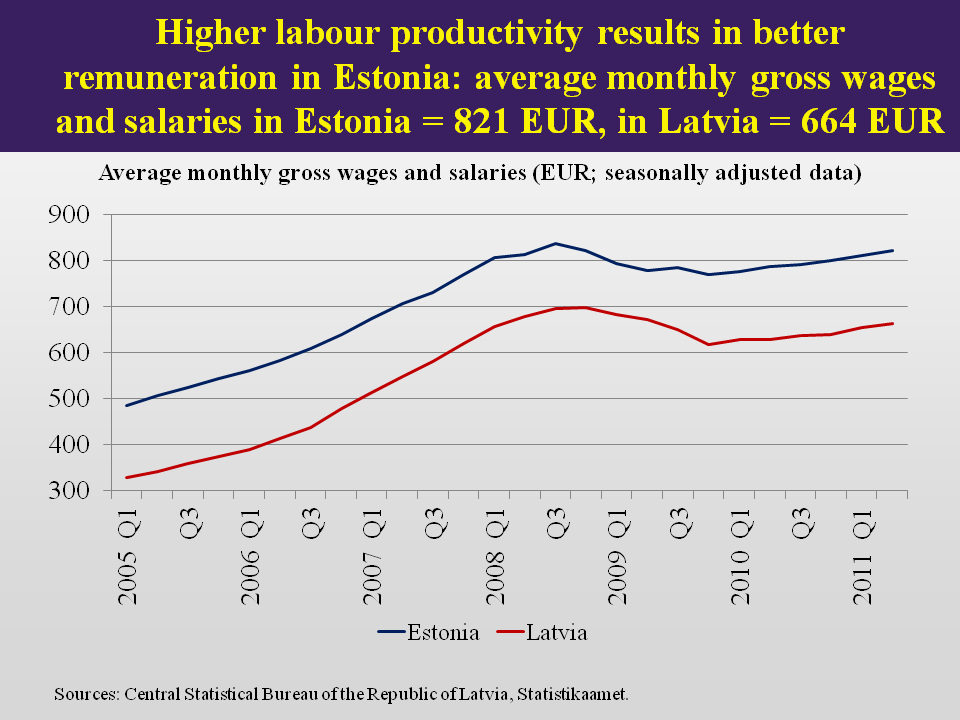

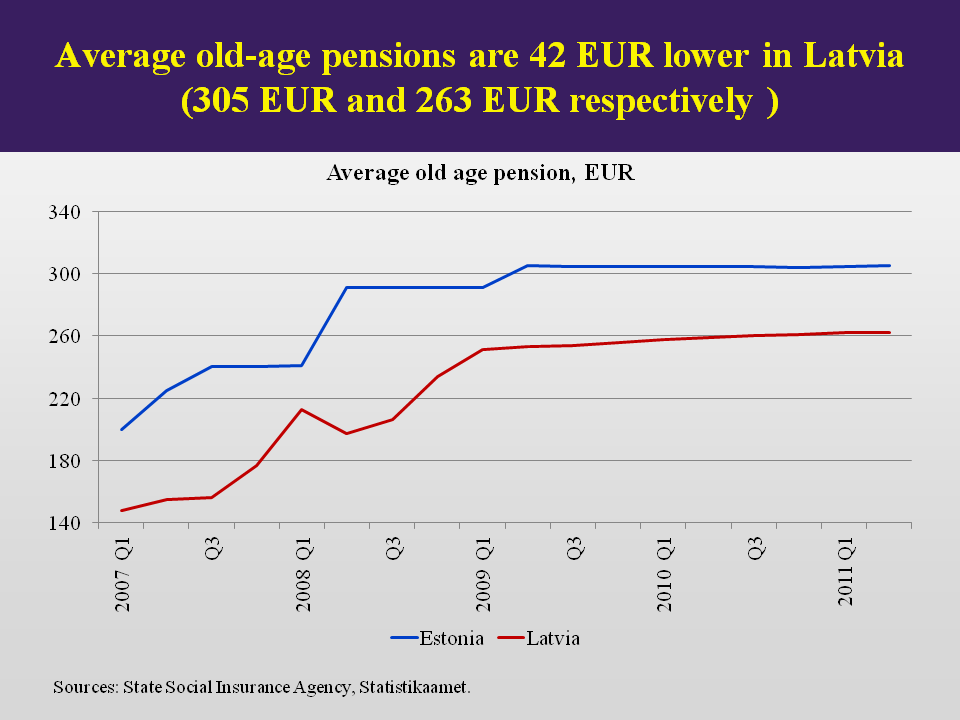

pensions, wages are higher in Estonia.

We could go on and on. But I know that many people get annoyed when Estonia is quoted as an example. They would be much happier to hear that the Estonians have made a mistake, have taken the wrong road and have boarded the Titanic, something we have all heard being mentioned. And still! There are also people who would ask: what should be done then?

The answer is that we must reduce the budgetary deficit!

The present crisis has clearly proved that less is more in this context, as the economy has managed to grow in the circumstances when the budgetary expenditure has been cut. And that is undeniable. Even our most ardent critics stand confused now: how can it be that cutting of spending leads to the recovery of economy and creation of new jobs, and the economic growth is one of the fastest in the EU. Latvia has managed to restore its competitiveness and Latvia is one of the fastest growing economies not only in the EU but globally! At all levels – the Parliament of the Republic of Latvia, Parliamentary committees, government –, everybody must understand and be convinced about the correctness of the decision to cut the budgetary deficit. The budgetary expenditure cuts must definitely continue! Not because the Bank of Latvia is saying so.

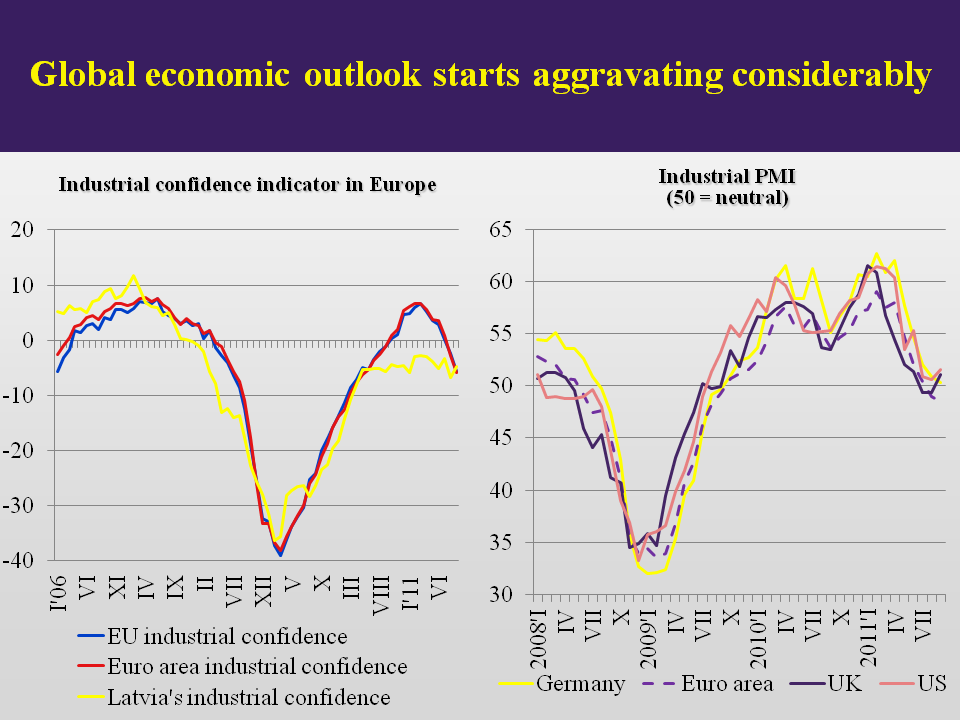

I hope that no one from the audience is going to say that the government is about to reduce spending because we must introduce the euro. The need to curb the budgetary deficit does not depend on euro adoption. No, the budgetary deficit has to be compressed because the economic situation in Europe is deteriorating day by day!

Three years ago, only a few mentioned the possibility of a second wave of the crisis. Today it is a common issue: no broadcasts, lectures or discussions are held without raising the issue of the probability of a second wave and the issue of when that could happen. The answer, unfortunately, is a simple one: it is definitely coming! We do not know, however, how strong it will be. Will everybody be washed overboard, only some or just one? Is the wave going to crash over our heads or will it only reach up to our ankles?

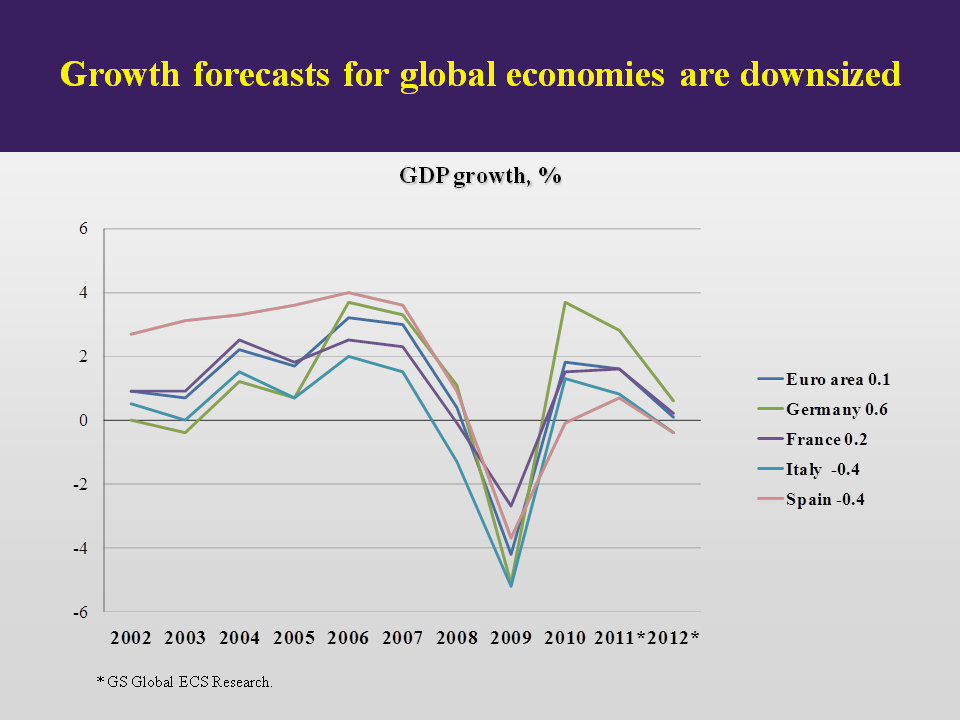

That the second wave of the crisis is, indeed, on its way is obvious even if we look at the latest forecasts of the leading economic analysis institutions and agencies. These forecasts are not encouraging. Sovereign credit ratings are downgraded, economic growth figures are adjusted downwards every week. These are the latest Goldman Sachs indicators. We can see that the EU growth is projected at 0.1% at best next year, while Italy and Spain will see no growth whatsoever.

We hear allegations every day that Latvia is ready for the second wave and the consequences are not going to be heavy because we stand prepared. I do not think that is true! If we are hit, Latvia's economic growth will decelerate even more than currently forecast. In the worst case scenario, it could end even several percentage points below zero, which could again mean lower budgetary revenue, higher unemployment and, most importantly – new and more sizeable consolidation and this would not be the final consolidation round as we previously have previously mentioned.

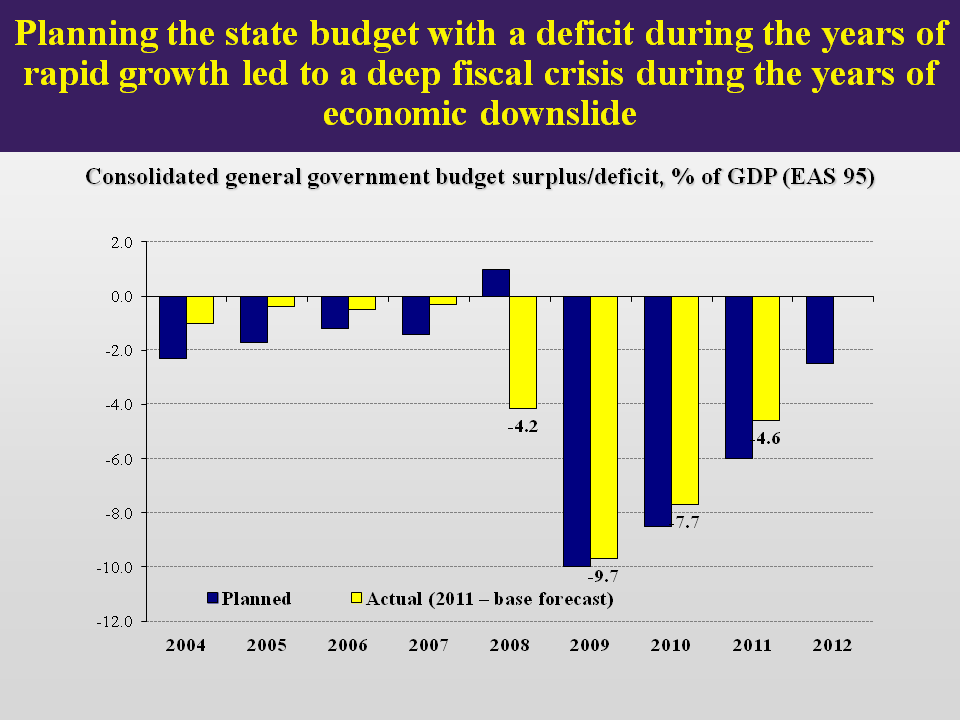

We could start speaking about Latvia being ready for the second wave of the crisis only if it had a balanced budget or a budget with a surplus, even a small one. Let's recall that in December 2007, at the very last possible moment, Latvia's government managed to draft and decided to submit to the Parliament a budget with a surplus. The year 2008 was the first year when Latvia finally had a surplus budget, yet it ended the year with a budgetary deficit of 5%. In the years to follow, the budgetary deficit was 17% and 11%.

What we can see here, 7% and 9%, is already after the implemented consolidation measures.

Therefore, at the current juncture we should first think about a balanced budget. And not just about somehow scraping through the needle's eye possibly to achieve 2.9% and believe that it is sufficient! The next year spending has to be cut by at least 150 million lats and the deficit has to be reduced to 2%, so that not to go above 3%, should the crisis be deeper, and put an end to Latvia's dream of introducing the euro. In 2013, Latvia's budget must definitely run a surplus. Latvia must finally adopt the fiscal accountability law, definitely introduce 3-year budgeting.

Ladies and gentlemen!

Latvia has survived three years of a severe crisis. We never said it was going to be easy. I would like to thank everyone who trusted in us and supported us. We have joined our efforts to show the rest of the world that the situation can be stabilised and growth can be restored. It can be accomplished without necessarily robbing the population in broad daylight. Namely, not through devaluation of the lats, but through prudent and better-targeted spending, at the same time improving the attractiveness of the economy in the eyes of investors and regaining competitiveness. We can say that the accomplishments in Latvia will make economists rewrite their textbooks. The new book will show that there is another way. It will be about how we managed to do it, despite wide disbelief.

To those who are asking the "what now" question and are willing to know more, the reply is that Latvia is standing at the crossroads now.

Shall we go in the direction of stability and adopt the euro or unfortunately move towards taking new stumbles and falls. This is the moment when we have to decide on which road to embark upon. Therefore, this really is not just another current budget. Our lives in the next 10 years depend on how we shall manage to adopt the 2012 budget! And it is not just a groundless allegation. Go visit our Estonian neighbours. The differences are obvious.

Unfortunately, I cannot get rid of the feeling that many people think that it's OK if we introduce the euro, but if not, nothing much will happen either! On the contrary! In a 10 years' time we shall find ourselves wondering again why our neighbours who have managed to adopt the euro lead a better and more prosperous life. The euro is, of course, not the only decisive factor. But still!

Firstly, it disciplines the economic decision-makers and at the same time enables joint decision-making and securing more favourable decisions for our future economic development, it enables Latvia to receive more revenue in the budget and creates new jobs as well as attracts investment.

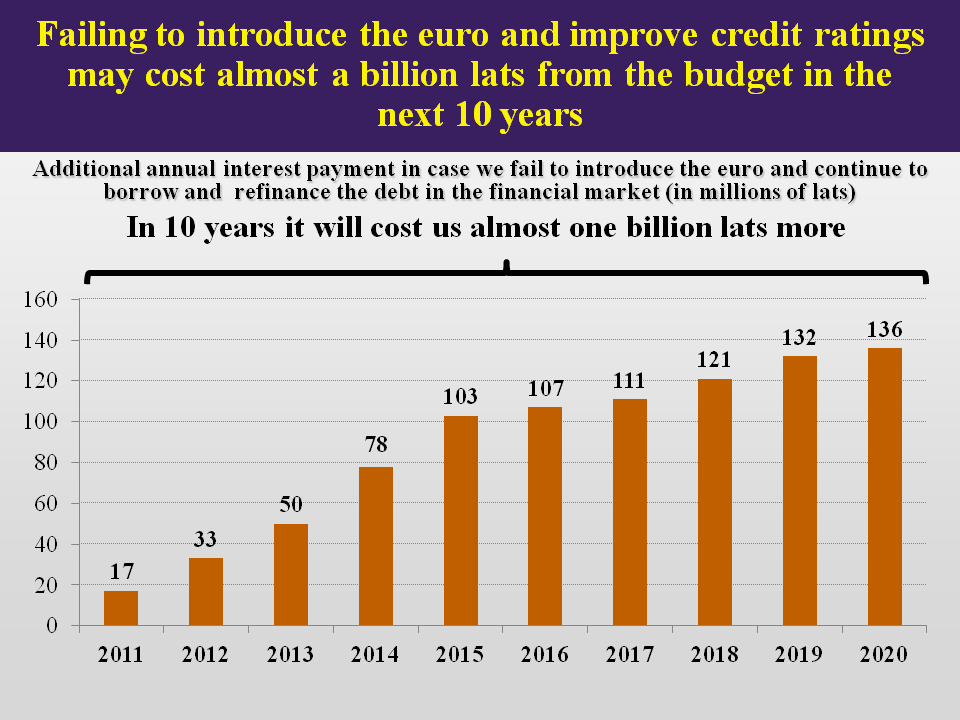

But the most important thing is to remember that in 2014 and 2015 Latvia will have to refinance the debt it undertook in the years of the crisis in the amount of 2.3 billion lats. And whether the interest we shall have to pay on it will be 2%–2.5% or 5.5%–6% is of an utmost importance.

The difference in monetary terms means that we shall have to pay a billion lats more on the debt in 10 years. And all because of the failure to adopt the euro!

Let me wish everyone an interesting and fruitful conference. And the main thing – to understand what should be done now when Latvia is at the crossroads. And that this time Latvia has no right to make a mistake.

-

Kopsavilkums

Konferenci ar ievadreferātu atklāja Latvijas Bankas prezidents Ilmārs Rimšēvičs.

Eiro zonas parādu krīzes risinājumu kontekstā konferences dalībniekiem klātienē un interneta tiešraidē bija interesanta Eiropas Centrālās bankas Valdes un Padomes locekļa Dr. oec. Jirgena Štarka (Jürgen Stark) uzstāšanās "Ekonomiskās korekcijas monetārajā savienībā". Jirgens Štarks ir labi zināms Eiropas ekonomists, viens no Eiropas vienotās valūtas arhitektiem.

Kā ierasts, tālāk konference noritēja divās daļās – ar starptautisku ekspertu un vietējā tirgus dalībnieku skatījumu un diskusiju.

Pirmā daļa "Ekonomiskās norises Eiropā un to ietekme uz Baltijas valstīm: akadēmiskais un politiskais skatpunkts" bija veltīta eiro ieviešanas analīzei – nesen notikušajai pārejai uz ES vienoto valūtu Igaunijā un sagaidāmajai Latvijā. Viens no diskusijas dalībniekiem – Somijas Bankas padomnieks Mertens Ross (Märten Ross) – strādājis par Igaunijas Bankas viceprezidentu no 2000. līdz 2011. gadam, tādējādi ietekmējot eiro ieviešanas procesu. Tas arī ļauj viņam spriest par to, kā Igaunija sasniegusi un nostiprinājusi makroekonomisko stabilitāti globālās finanšu un Eiropas parādu krīzes apstākļos.

Otrajā daļā "Latvijas eksports: potenciāls, problēmas un nākotnes iespējas", izsekojot uzņēmuma, nozares pārstāvniecības, bankas un eksportu veicinošās valsts institūcijas stāstam, bija iespēja saredzēt, vai pašlaik sasniegtajam straujajam eksporta kāpumam ir ilglaicīgs pamats, atrast vājos ķēdes posmus un diskutēt par praktiskiem darbiem uzņēmumu konkurētspējas uzlabošanai.

-

Video kopsavilkums

Dr. oec. Raita Karnīte un Latvijas Bankas Monetārās politikas pārvaldes vadītājs Kārlis Bauze atskatās uz svarīgāko konferencē.

Vēlos informēt, ka tekstā:

«… …»

Jūsu interneta pārlūkā saglabāsies tā pati lapa